Job Market Paper

Competition in Employer Sponsored Health Insurance: Implications for a Public Option

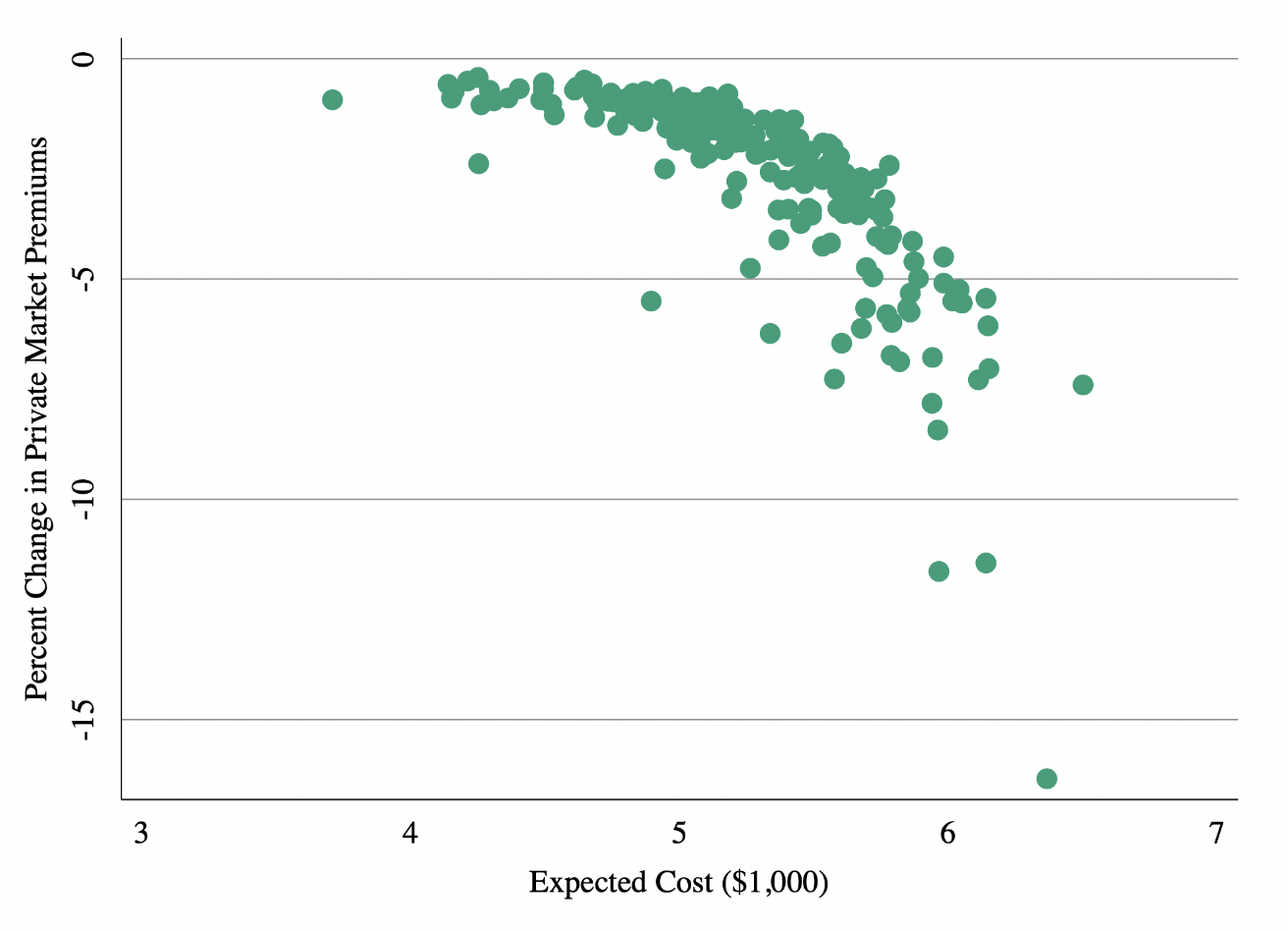

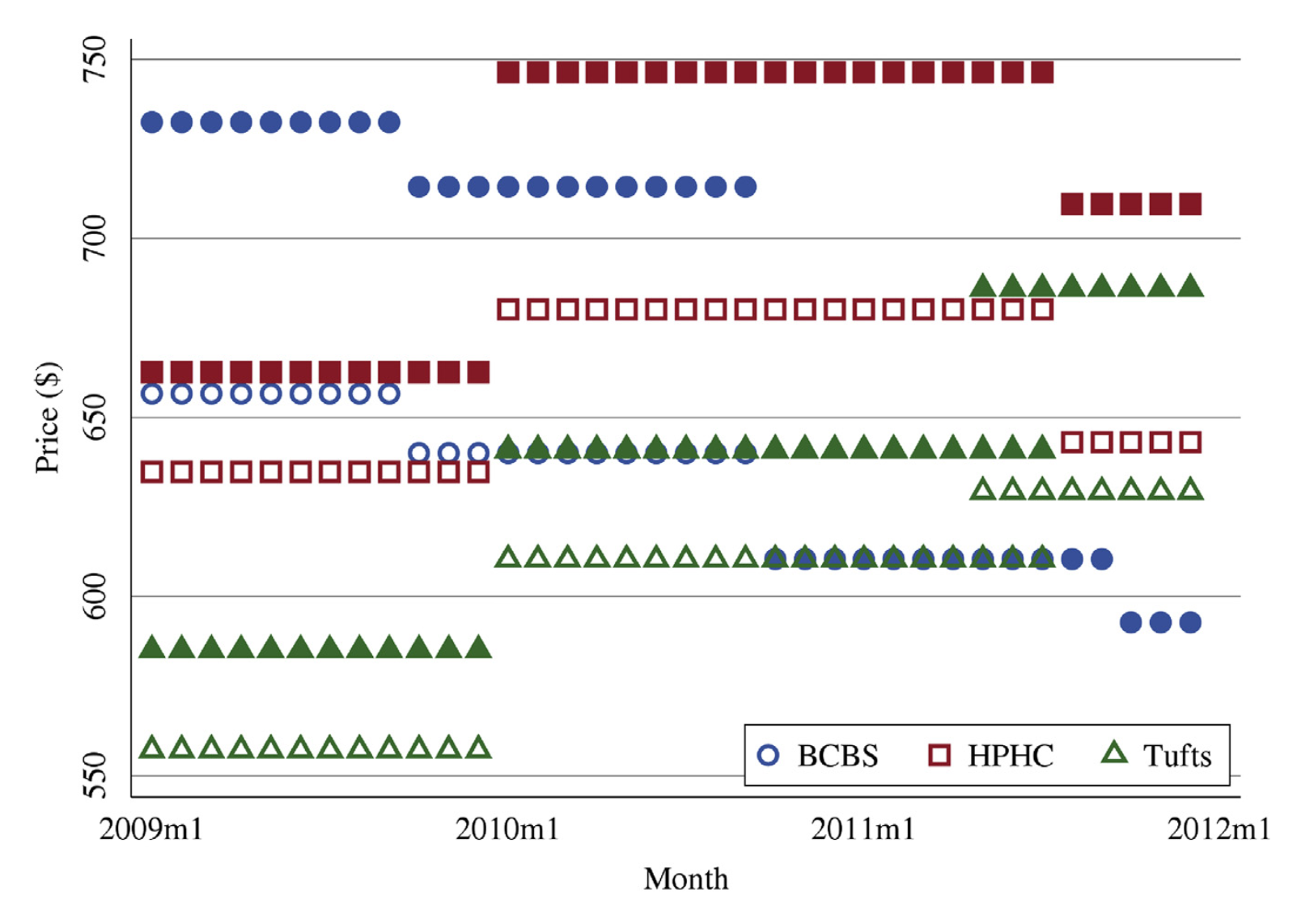

I explore the conditions under which a government insurance plan, or “public option,” generates additional premium competition in the insurance market. Using unique data on employer-insurer contracting and a model of supply and demand, I document evidence of large switching costs and variation in expected costs across employers. Insurers respond to switching costs by setting low premiums for new employers and raising them for those who are locked-in. I use the model to test the impact of a public option and show show that uniform premium setting (i.e. community rating) substantially limits the public option’s ability to compete with private insurers who set employer-specific premiums. A public option that offers experience rated premiums and discounts to new employers is substantially more attractive and therefore has a larger impact on premium competition. A community rated public option that aggressively regulates prices for health care services obtains substantial market share, but is less effective at generating competition among existing insurers.

Published Papers

Economics

How Important Is Price variation Between Health Insurers? Journal of Health Economics, 2021, with Keith Ericson and Amanda Starc

Prices negotiated between payers and providers affect a health insurance contract’s value via enrollees’ cost-sharing and self-insured employers’ costs. However, price variation across payers is difficult to observe. We measure negotiated prices for hospital-payer pairs in Massachusetts and characterize price variation. Between-payer price variation is similar in magnitude to between-hospital price variation. Administrative-services-only contracts, in which insurers do not bear risk, have higher prices. We model negotiation incentives and show that contractual form and demand responsiveness to negotiated prices are important determinants of negotiated prices.

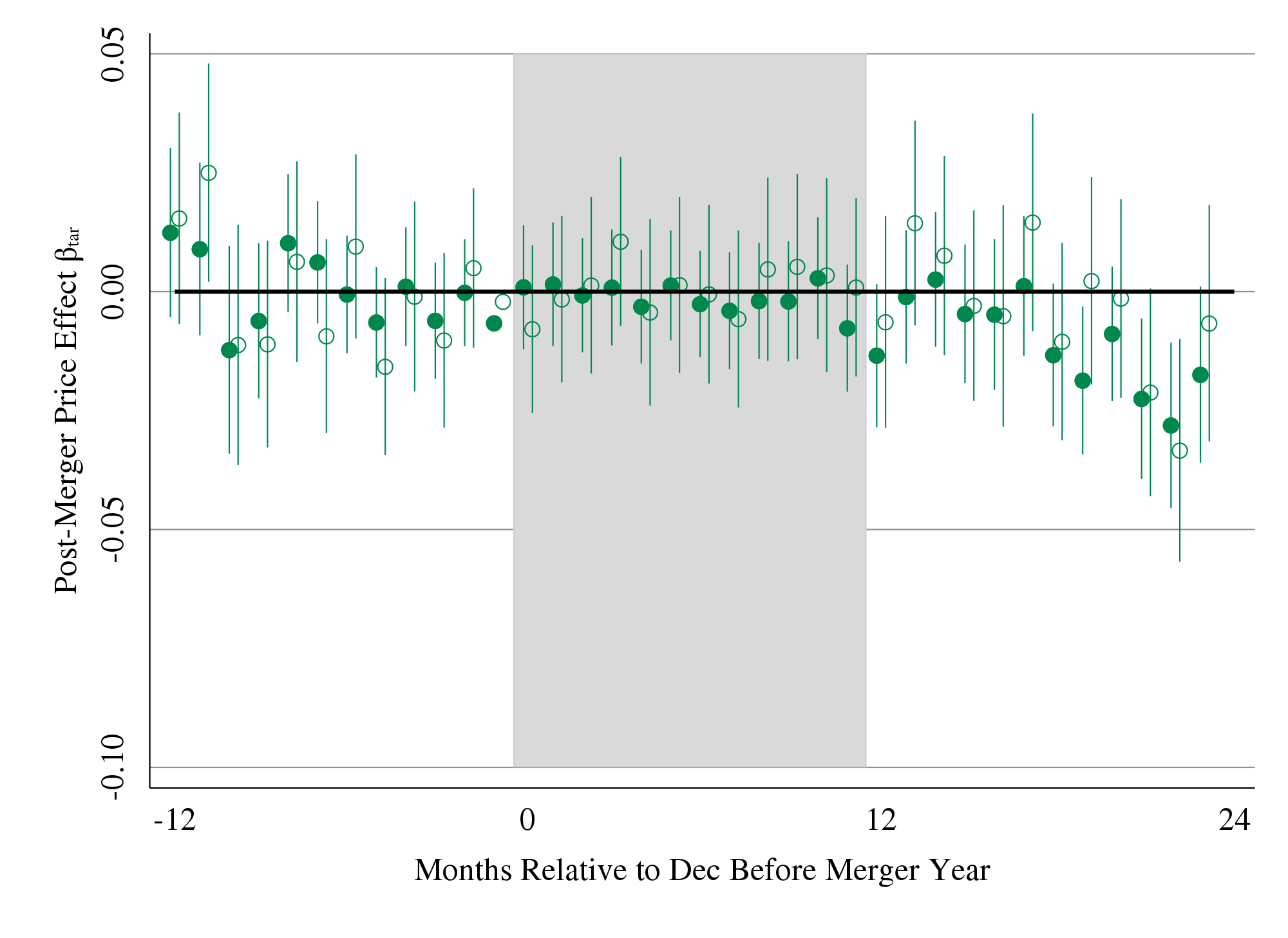

Mergers and Marginal Costs: New Evidence from Hospital Input Markets, RAND Journal of Economics, 2021, with Matthew Grennan and Ashley Swanson

We estimate the effects of hospital mergers, using detailed data containing medical supply transactions (representing 23 percent of operating costs) from a sample of US hospitals 2009-2015. Pre-merger price variation across hospitals (Gini coefficient 7 percent) suggests significant opportunities for cost decreases. However, we observe limited evidence of actual savings. In this retrospective sample, targets realized 1.9 percent savings; acquirers realize no significant savings. Examining treatment effect heterogeneity to shed light on theories of "buyer power," we find that savings, when they occur, tend to be local, and potential benefits of savings may be offset by managerial costs of merging.

Press: NBER Digest, Modern Healthcare, Axios, Advisory Board

The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured, Quarterly Journal of Economics, 2019, with Zack Cooper, Martin Gaynor, and John Van Reenen

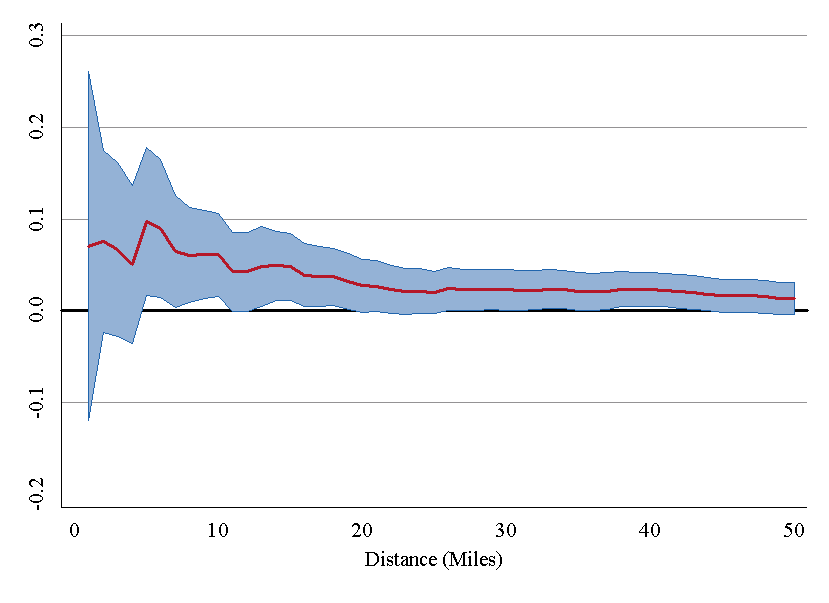

We use insurance claims data to study the variation in health spending on the privately insured, examine the structure of insurer-hospital contracts, and analyze the variation in hospital prices across the nation. Prices vary substantially across regions, across hospitals within regions, and even within hospitals. Hospital market structure is strongly associated with price levels and contract structure. Prices at monopoly hospitals are 12% higher than those in markets with four or more rivals. Monopoly hospitals also have contracts that load more risk on insurers. In concentrated insurer markets the opposite occurs—hospitals have lower prices and bear more financial risk. Examining the 366 mergers and acquisitions that occurred between 2007 and 2011, we find that prices increased by over 6% when the merging hospitals were geographically close (e.g., 5 miles or less apart), but not when the hospitals were geographically distant (e.g., over 25 miles apart).

Press: NYT, WSJ, New Yorker, NPR Marketplace, Vox, More links here

Health, Policy, Measurement

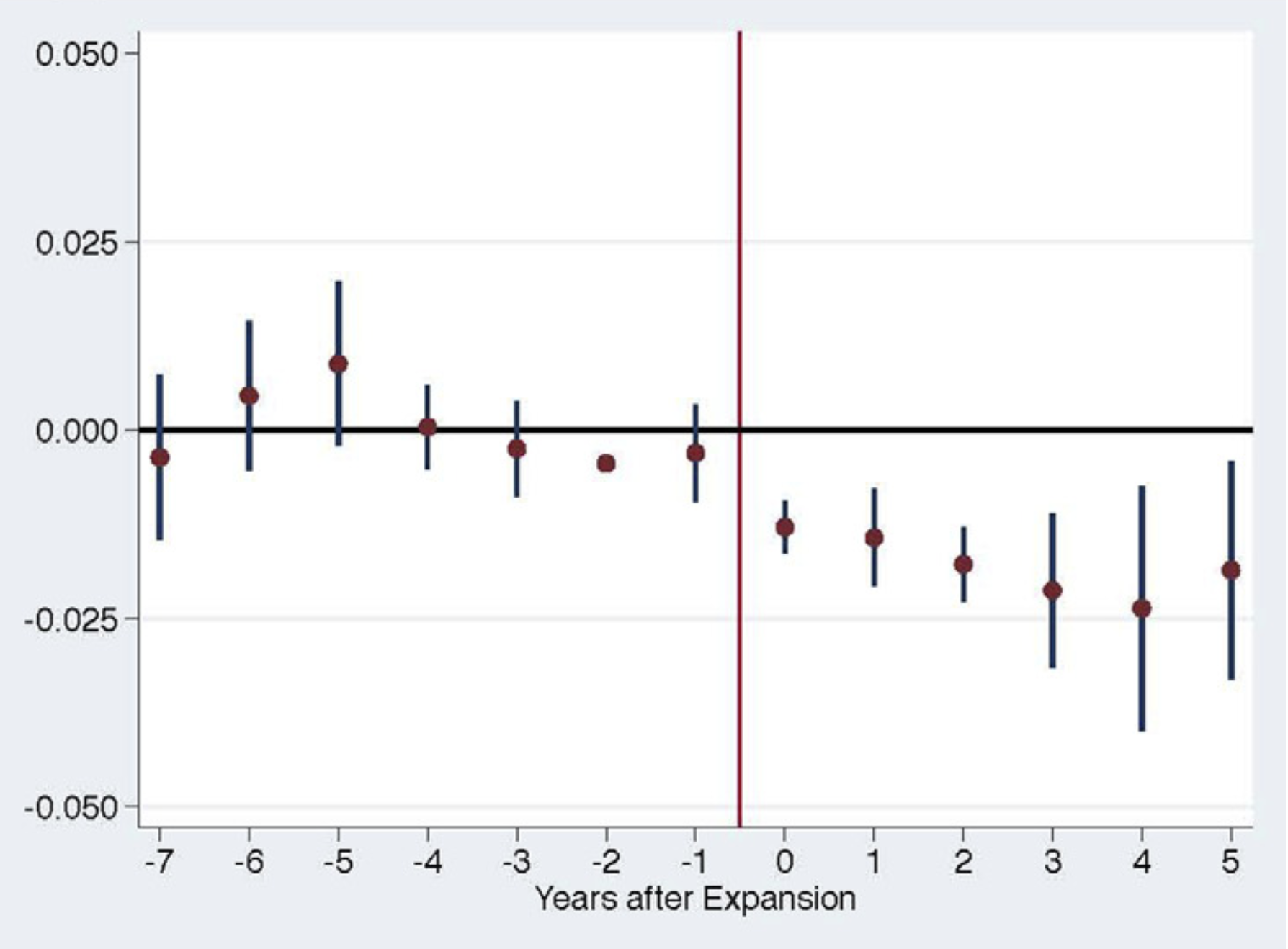

Impact of Medicaid Expansion on Women with Gynecologic Cancer: a Difference-in-Difference Analysis, American Journal of Obstetrics and Gynecology, 2020, with Benjamin B. Albright, Dimitrios Nasioudis, Haley A. Moss, Nawar A. Latif, Emily M. Ko, and Ashley F. Haggerty

Using data from the National Cancer Database, we study the impact of state-level policy to expand Medicaid on access to care for women with gynecologic cancer. Using a difference-in-difference approach, we find that states that expanded Medicaid reduced the rate of uninsurance at diagnosis by 2pp. Medicaid expansion also generated a 0.8pp increase in early stage diagnosis, a 1.62 pp increase in treatment within 30 days of diagnosis, and 1.54pp incrase in surgery within 30 days of diagnosis. We estimate particularly large gains for women living in low-income zip codes, Hispanic women, and women with cervical cancer.

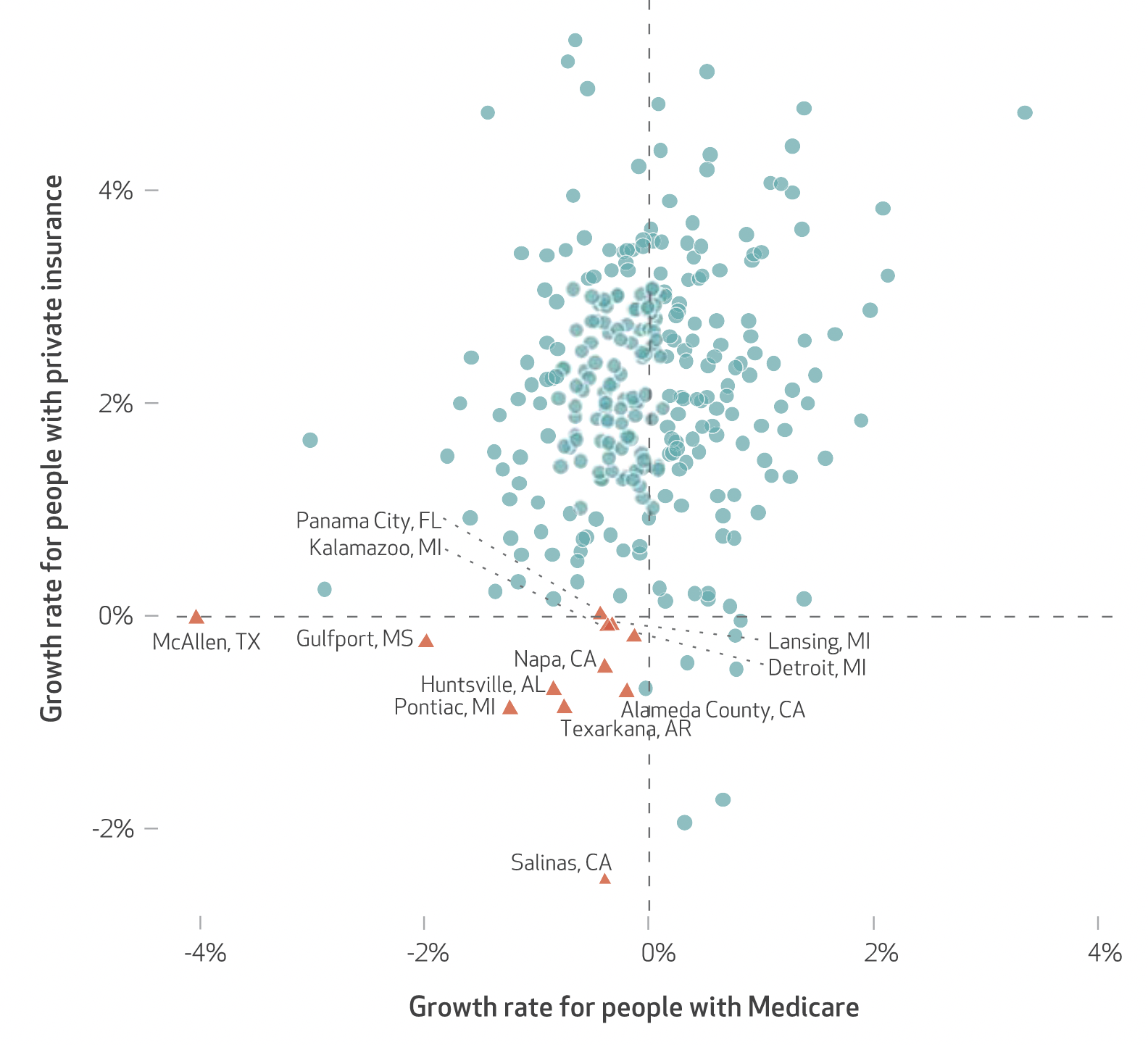

Variation In Health Spending Growth For the Privately Insured From 2007 to 2014, Health Affairs, 2019, with Zack Cooper, Charles Gray, Martin Gaynor, and John Van Reenen

We examined the growth in health spending on people with employer-sponsored private insurance in the period 2007–14. In the study period private health spending per enrollee grew 16.9 percent, while growth in Medicare spending per fee-for-service beneficiary decreased 1.2 percent. There was substantial variation in private spending growth rates across hospital referral regions (HRRs): Spending in HRRs in the tenth percentile of private spending growth grew at 0.22 percent per year, while HRRs in the ninetieth percentile experienced 3.45 percent growth per year. The correlation between the growth in HRR-level private health spending and growth in fee-for-service Medicare spending in the study period was only 0.211, suggesting that different factors may be driving the growth in spending on the two populations.

Press: Modern Healthcare

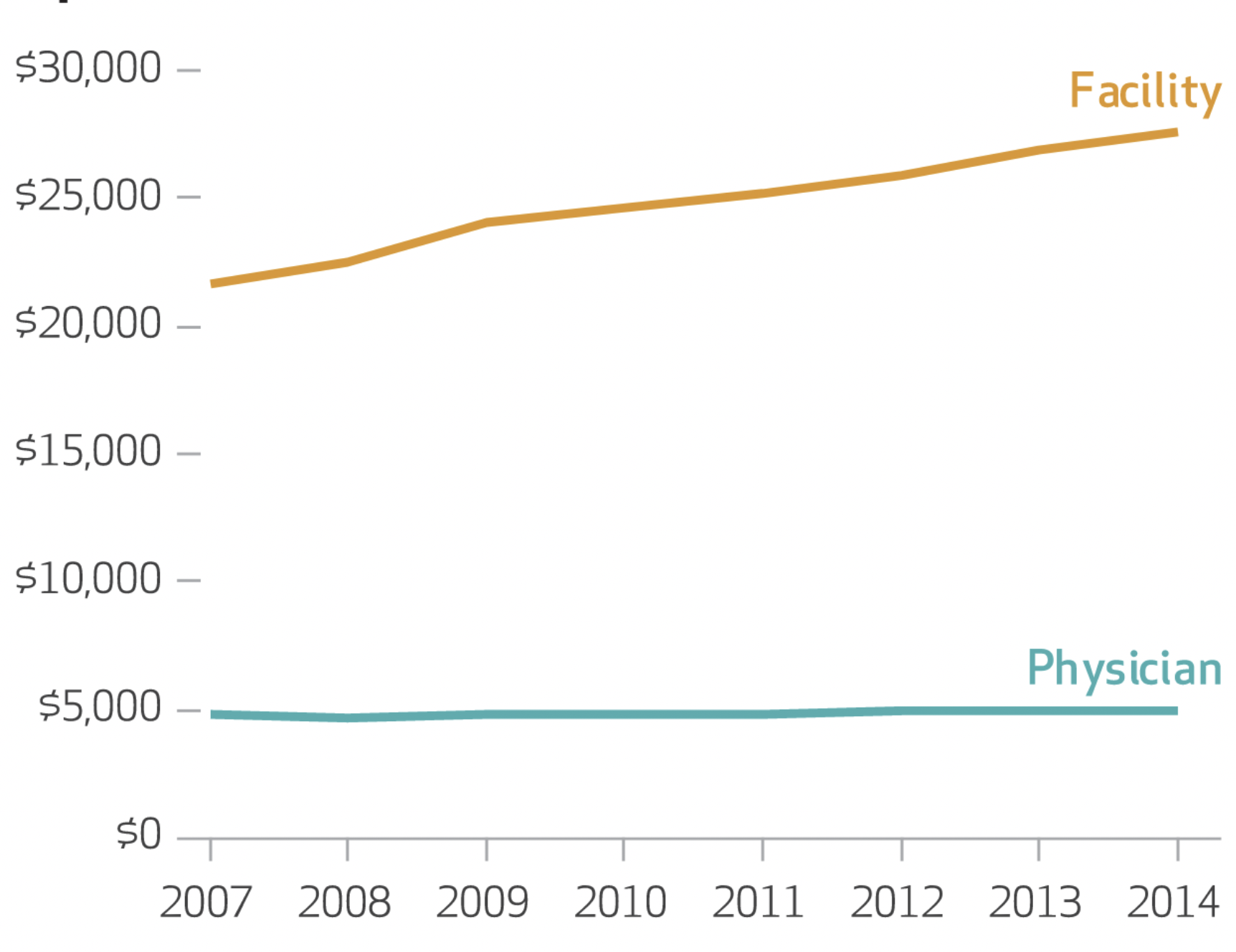

Hospital Prices Grew Substantially Faster Than Physician Prices For Hospital-Based Care In 2007-2014, Health Affairs, 2019, with Zack Cooper, Martin Gaynor, Nir J. Harish, Harlan M. Krumholz, and John Van Reenen

We analyzed growth in both types of prices for inpatient and hospital-based outpatient services using actual negotiated prices paid by insurers. We found that in the period 2007–14 hospital prices grew substantially faster than physician prices. For inpatient care, hospital prices grew 42 percent, while physician prices grew 18 percent. Similarly, for hospital-based outpatient care, hospital prices grew 25 percent, while physician prices grew 6 percent. Policy makers should consider a range of options to address hospital price growth, including antitrust enforcement, administered pricing, the use of reference pricing, and incentivizing referring physicians to make more cost-efficient referrals.

Press: Modern Healthcare

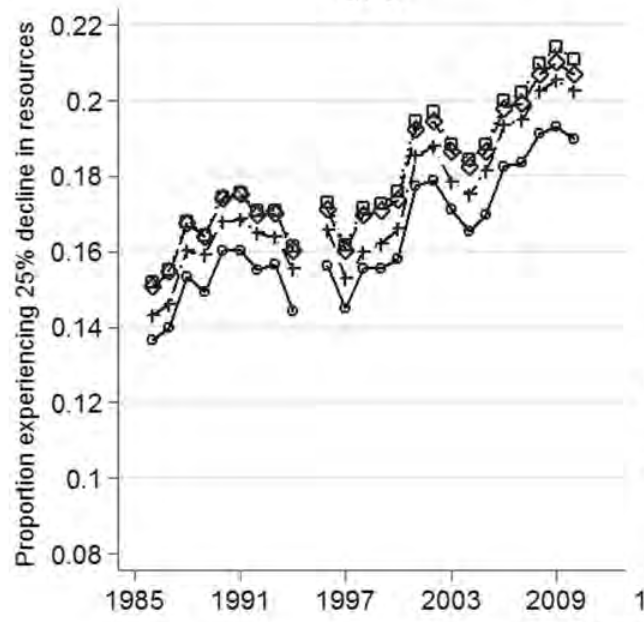

The Economic Security Index: A New Measure for Research and Policy Analysis The Review of Income and Wealth, 2014, with Jacob S. Hacker, Gregory A. Huber, Austin Nichols, Philipp Rehm, Mark Schlesinger, and Robert G. Valletta

The ESI assesses the individual-level occurrence of substantial year-to-year declines in available household resources, accounting for fluctuations not only in income but also in out-of-pocket medical expenses. It also assesses whether those experiencing such declines have sufficient liquid financial wealth to buffer against these shocks. We find that economic insecurity has risen steadily since the mid-1980s for virtually all sub-groups of Americans, though there is substantial disparity in the degree to which different subgroups are exposed to economic risk. We find that the degree and disparity by which insecurity has risen is robust across the best available data sources.

Press: Lots of links here

Works in Progress

Vertical Integration and Control: Evidence from Medical Technology, with Matt Grennan, Joseph Martinez, and Ashley Swanson

The Impact of Rising Health Care Costs on People, Places, and Firms, with Zarek Brot-Goldberg, Zack Cooper, and Ithai Lurie

Comparing Ex Ante and Ex Post Evaluation Approaches; Evidence from Horizontal Hospital Mergers, with Zarek Brot-Goldberg and Zack Cooper

Decomposing the Effects of Vertical Integration on Health Care Spending, with Zack Cooper, Matthew Grennan, Joseph Martinez, Fiona Scott Morton, and Ashley Swanson

Health Care Spending Effects of Patients, Providers, and Places: Evidence from the Military Health System, with Amy Bond and Steve Schwab